Understanding Forex Trading A Comprehensive Guide 1659776329

What is Forex Trading?

Forex trading, also known as foreign exchange trading, is a decentralized global market where all the world’s currencies are traded. It is one of the largest financial markets in the world, with a daily trading volume exceeding $6 trillion. In this article, we will delve into the intricacies of forex trading, exploring its mechanics, benefits, and strategies for success. For more in-depth resources on forex trading, visit what is forex trading https://acev.io/.

1. The Basics of Forex Trading

Forex trading revolves around the buying and selling of currency pairs. Each currency pair consists of two currencies: the base currency and the quote currency. For instance, in the currency pair EUR/USD, the Euro (EUR) is the base currency and the US Dollar (USD) is the quote currency. Traders speculate on whether the base currency will strengthen or weaken against the quote currency.

The forex market operates 24 hours a day, five days a week, enabling traders from around the globe to participate at any time. Unlike stock markets, which have specific operating hours, the forex market allows for constant trading, providing significant flexibility for traders.

2. How Forex Trading Works

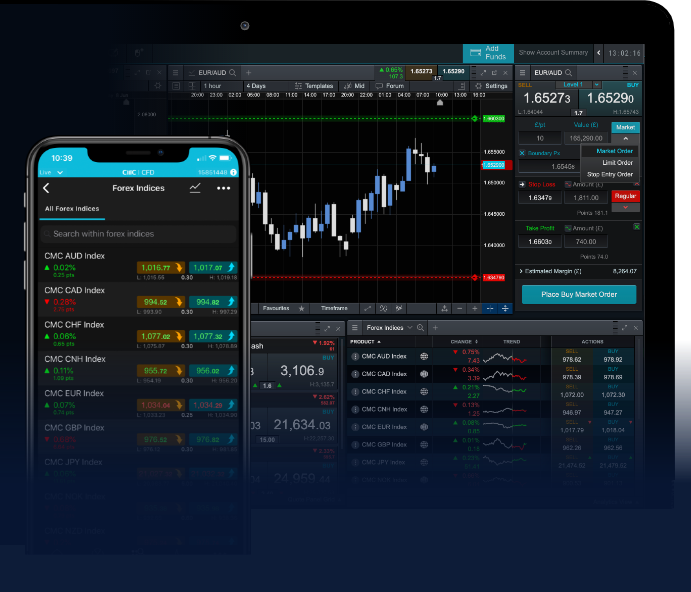

Forex trading occurs in major financial centers around the world, including London, New York, Tokyo, and Sydney. The market is facilitated through a network of banks, financial institutions, and retail brokers. Traders access this market through online trading platforms that provide a range of tools and resources for market analysis and trade execution.

Forex trades are typically conducted over-the-counter (OTC), meaning there is no central exchange where these transactions take place. Instead, traders interact directly with one another or through electronic networks, allowing for greater efficiency and immediacy in trading.

3. Key Terms and Concepts

To understand forex trading better, it’s essential to familiarize yourself with some key terms:

- Pip: A pip (percentage in point) is the smallest price move that a given exchange rate can make. It usually represents a one-digit movement in the fourth decimal place for most currency pairs.

- Leverage: Leverage in forex trading allows traders to control larger positions with a smaller amount of capital. For example, a 100:1 leverage means that for every $1 of your own capital, you can control $100 in the market.

- Spread: The spread is the difference between the buying (ask) price and selling (bid) price of a currency pair. It represents the transaction cost for traders.

- Lot: A lot refers to a standardized unit of measurement for trading in the forex market. Standard lots typically consist of 100,000 units of the base currency.

4. Types of Forex Markets

The forex market can be segmented into three primary types:

- Spot Market: The spot market involves the immediate exchange of currencies at the current market price.

- Forward Market: In the forward market, currencies are exchanged at a specified price on a specified future date.

- Futures Market: Similar to the forward market, futures involve contracts to buy or sell currencies at a predetermined price in the future, but these contracts are standardized and traded on exchanges.

5. Benefits of Forex Trading

There are several advantages to engaging in forex trading:

- Liquidity: The forex market is highly liquid, allowing traders to enter and exit positions easily.

- Accessibility: With trading platforms available online, forex trading is accessible to anyone with an internet connection.

- Potential for Profit: The ability to trade with leverage can amplify profits, although it also increases risk.

- Diverse Trading Opportunities: Traders can diversify their portfolios by trading multiple currency pairs, taking advantage of various economic conditions.

6. Risks Associated with Forex Trading

While forex trading offers numerous benefits, it is also accompanied by risks:

- Market Volatility: Currency prices can be highly volatile, leading to rapid losses as well as gains.

- Leverage Risk: While leverage can magnify profits, it can also amplify losses. Traders must manage their leverage carefully.

- Counterparty Risk: This refers to the risk that the broker or financial institution may default on their obligations.

7. Developing a Trading Strategy

A trading strategy is essential for success in the forex market. Here are a few popular strategies:

- Day Trading: Day traders enter and exit positions within the same trading day, aiming to profit from short-term price movements.

- Swing Trading: Swing traders hold on to positions for several days or weeks, capitalizing on longer-term price trends.

- Scalping: Scalpers make rapid trades, often holding positions for mere minutes, to capture small price changes.

8. Tools and Resources for Forex Trading

Various tools and resources can aid traders in their forex journey:

- Charts and Technical Analysis: Utilizing charts and indicators can help traders analyze price movements and identify trends.

- Economic Calendar: An economic calendar lists key events that can impact currency prices, such as economic reports, central bank announcements, and geopolitical developments.

- Demo Accounts: Many brokers offer demo accounts that allow traders to practice trading with virtual currency before risking real money.

Conclusion

Forex trading is a dynamic and complex financial market that draws participants from around the globe. While it offers lucrative opportunities for profit, it is fraught with risks. Therefore, aspiring traders must educate themselves continually, develop solid trading strategies, and approach the market with discipline and patience. With the right tools, knowledge, and a commitment to continuous learning, anyone can embark on a successful forex trading journey.